CAFE Standards 2027: Impact on US Automakers Explored

The updated Corporate Average Fuel Economy (CAFE) standards set for 2027 are poised to significantly reshape the landscape for US automakers by mandating higher fuel efficiency, thereby accelerating the transition to electric vehicles and pressuring companies to innovate or risk penalties and market share shifts.

The automotive industry stands at a pivotal juncture, grappling with a complex regulatory landscape that promises to redefine how vehicles are designed, manufactured, and sold. Central to this transformation are the updated Corporate Average Fuel Economy (CAFE) standards, which are set to exert significant influence on US automakers by 2027. This shift isn’t merely about incremental improvements; it’s a profound push towards a more sustainable, energy-efficient future, presenting both formidable challenges and unprecedented opportunities for a sector deeply embedded in the American economy.

Understanding the Updated CAFE Standards

The journey towards enhanced fuel efficiency standards is not new, tracing its origins back to the energy crises of the 1970s. However, the latest iteration of CAFE standards, particularly those targeting 2027, signifies a renewed and intensified commitment to reducing greenhouse gas emissions and decreasing reliance on fossil fuels. These updates are significantly more aggressive than previous mandates, demanding a rapid acceleration in the adoption of advanced automotive technologies.

The core of the CAFE program resides in setting average fuel economy targets for a manufacturer’s entire fleet of vehicles sold in the U.S. Rather than regulating individual models, it aggregates data across all cars and light trucks. This approach incentivizes automakers to balance their sales mix, promoting more efficient vehicles to offset less efficient ones. The 2027 targets raise the bar substantially, requiring a year-over-year increase in fuel economy that necessitates a fundamental shift in product strategies. Policymakers aim to drive innovation, pushing companies to invest heavily in research and development for cleaner powertrains and lighter materials.

This policy mechanism creates a direct link between environmental goals and economic activity. Companies that fail to meet the mandated averages face hefty financial penalties, which can quickly erode profit margins. Conversely, exceeding the standards can provide credits that can be sold to other manufacturers, creating a market-based incentive for over-compliance. The standards are designed to be technology-neutral, meaning they do not dictate specific technologies, but rather set performance outcomes, allowing manufacturers the flexibility to choose the most cost-effective and innovative solutions. This hands-off approach to methodology is intended to spur diverse engineering solutions rather than narrow technological conformity.

Historical context of fuel efficiency regulations

The origins of CAFE standards can be traced back to the Energy Policy and Conservation Act of 1975, a direct response to the 1973 oil embargo. Initial targets focused on doubling passenger car fuel economy by 1985. Subsequent revisions have occurred over decades, often influenced by political shifts, technological advancements, and evolving energy concerns. The recent updates under the Biden administration represent a significant tightening of these regulations, reversing less stringent targets set previously. This historical trajectory highlights a persistent tension between environmental protection, energy security, and economic competitiveness within the automotive industry.

Key metrics and targets for 2027

The 2027 CAFE standards introduce aggressive annual percentage increases in miles per gallon (MPG) for both passenger cars and light trucks. While specific numerical targets can vary slightly based on final rulemaking adjustments, the overarching goal is a substantial increase in fleet-wide average fuel economy. This typically translates to a mid-single-digit percentage improvement each year, leading to a dramatic cumulative increase by 2027. Manufacturers must develop vehicles that are significantly more efficient than current models or drastically increase their sales of electric vehicles (EVs) to meet these new benchmarks. The targets are also often footprint-based, meaning larger vehicles have slightly lower, but still demanding, targets, while smaller vehicles have higher ones. This nuanced approach acknowledges vehicle utility while maintaining aggressive efficiency goals across the board.

- Mandatory annual MPG increases for new vehicle fleets.

- Focus on a substantial reduction in tailpipe emissions across vehicle classes.

- Incentivization of electric vehicle sales to offset lower-efficiency internal combustion engine (ICE) vehicles.

- Potential for significant financial penalties for non-compliance.

The regulatory framework also considers attributes beyond just fuel economy, such as vehicle safety and utility, to ensure a holistic approach. Automakers are given some flexibility through credit trading systems and advanced technology credits, which allow them to gain compliance by deploying innovations. This dynamic system attempts to balance strict environmental goals with practical industry constraints, fostering a continuous cycle of technological advancement. The complexity of these metrics requires sophisticated planning and investment from every major manufacturer.

The Push Towards Electrification

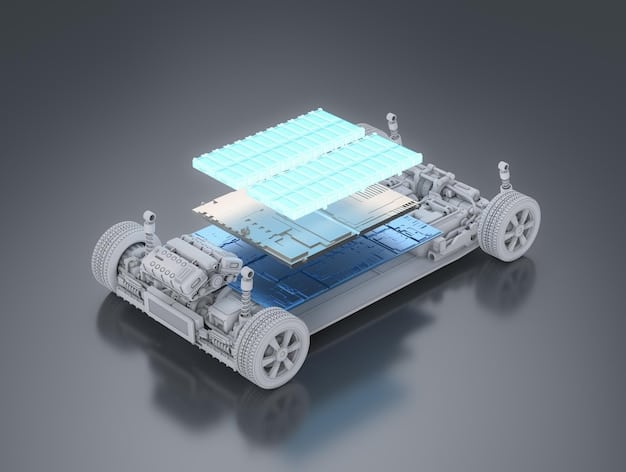

The updated CAFE standards are not just about incremental improvements in gasoline-powered vehicles; they are a powerful accelerant for the transition to electric vehicles. Meeting the stringent 2027 targets without a significant increase in EV sales will be exceedingly difficult, if not impossible, for most US automakers. EVs, by their very nature, produce zero tailpipe emissions and are factored into CAFE calculations in a way that heavily favors their adoption. This regulatory push complements other government incentives and infrastructure investments aimed at building a robust EV ecosystem in the United States.

Automakers are responding by rapidly expanding their EV portfolios, investing billions in new electric platforms, battery technologies, and manufacturing facilities. Companies are moving from merely offering a few EV models to designing entire lineups around electric powertrains. This shift requires retooling factories, retraining workforces, and establishing new supply chains for critical components like battery cells and rare earth minerals. The strategic decision to pivot towards electrification is driven by both regulatory compliance and a growing consumer demand for sustainable transportation options. The market is increasingly segmenting into those who embrace EVs and those who remain hesitant, necessitating a broad strategy from manufacturers to capture both demographics.

Investment in EV production and technology

Major US automakers like General Motors, Ford, and Stellantis (owner of Chrysler, Dodge, Jeep, and Ram) have publicly committed to ambitious electrification goals, pledging tens of billions of dollars towards EV research, development, and manufacturing. This includes building new battery plants, converting existing assembly lines for EV production, and investing in charging infrastructure and battery recycling initiatives. The scale of this investment reflects the perceived necessity of embracing EVs to remain competitive and compliant in the future automotive landscape. It also underscores a long-term vision where internal combustion engines play a diminishing role in their product mix.

Challenges of scaling EV adoption

Despite significant investments, scaling EV adoption presents numerous hurdles. These include the high upfront cost of EVs compared to traditional gasoline cars, concerns about charging infrastructure availability and speed, range anxiety, and the availability of critical raw materials for batteries. Automakers must also overcome consumer hesitancy and educate the public on the benefits and practicalities of owning an EV. Building a robust supply chain for batteries, particularly within North America, is also a formidable challenge, requiring new mining operations and processing facilities. Furthermore, the capacity of the electric grid to support widespread EV charging is an ongoing consideration for utilities and policymakers. Addressing these challenges requires a concerted effort from government, industry, and consumers.

- High initial purchase price of electric vehicles.

- Developing a comprehensive and reliable charging infrastructure.

- Ensuring availability of critical battery raw materials.

- Educating and convincing a broad consumer base to switch to EVs.

The transition is not just about producing EVs, but also ensuring they are accessible, convenient, and reliable for the average consumer. This involves not only technological advancements but also changes in public perception and logistical support. The pace of this transformation will largely dictate how effectively automakers can meet the 2027 CAFE targets. The success of the electrification push depends on a strong interplay between technological readiness and market acceptance.

Impact on Traditional Internal Combustion Engine (ICE) Vehicles

While much of the focus is on electrification, the updated CAFE standards will also profoundly affect the development and market position of traditional internal combustion engine (ICE) vehicles. Automakers cannot simply abandon ICE vehicles overnight; they remain a significant portion of current sales and provide the revenue stream necessary to fund EV transitions. Therefore, ICE vehicles must become significantly more fuel-efficient to comply with the stricter 2027 mandates, even as their overall market share is expected to decline. This means engineers are redoubling efforts to squeeze every possible ounce of efficiency from gasoline and diesel powertrains.

The challenge lies in making these efficiency gains without dramatically increasing costs or compromising performance, factors that are critical for consumer acceptance. Technologies like advanced direct injection, turbocharging, cylinder deactivation, and sophisticated hybrid systems will become standard across a wider range of vehicles. Automakers will also need to focus on reducing vehicle weight through lighter materials and optimizing aerodynamic designs. This dual approach—pushing electrification while refining ICE technology—is a delicate balancing act, as resources must be allocated strategically. The continued necessity of ICE vehicles in the fleet means their efficiency improvements are still a major component of regulatory compliance.

Technological advancements in gasoline engines

The push for greater ICE efficiency is driving innovation in several areas. Engineers are refining traditional engine components, implementing advanced combustion strategies, and integrating mild-hybrid systems. These advancements aim to reduce friction, improve thermal efficiency, and optimize fuel delivery. Specific technologies include:

- Advanced direct injection: More precise fuel delivery for better combustion.

- Turbocharging and supercharging: Smaller engines achieve higher power with improved efficiency.

- Cylinder deactivation: Temporarily shutting off cylinders during light loads to save fuel.

- Start-stop systems: Turning off the engine when the vehicle is stationary.

- Continuously Variable Transmissions (CVTs) and multi-speed automatics: Optimizing engine RPM for efficiency.

- Mild-hybrid systems: Small electric motors assisting the ICE for improved fuel economy during acceleration and braking.

These technologies, while not as transformative as full electrification, are crucial for incremental gains in the efficiency of the millions of ICE vehicles still expected to be sold between now and 2027 and beyond. They represent the continuing evolution of a mature technology, squeezing out every last bit of performance and efficiency.

Market implications for traditional vehicle segments

The increased cost of integrating advanced efficiency technologies into ICE vehicles could impact pricing, potentially making these vehicles more expensive for consumers. This might further accelerate the shift towards EVs, especially if battery costs continue to decline. Furthermore, manufacturers may choose to streamline their offerings, potentially discontinuing less fuel-efficient models or trims that become too costly to update to meet standards. The market for large, heavy, and very powerful gasoline-only vehicles may shrink unless significant hybridization or other efficiency measures are implemented. This segment is particularly challenged by the footprint-based efficiency targets. The competitive landscape will also shift as brands that successfully adapt their ICE lineups or transition quickly to EVs gain an advantage. The sheer diversity of market preferences for vehicle size and type means that ICE vehicles will not disappear quickly, but their composition will change.

The pressure to innovate in the ICE space is immense, but it is clear that these vehicles will play a diminishing role in the long term, even as their efficiency improves. The strategic allocation of R&D budgets is critical, balancing short-term compliance with long-term technological shifts.

Financial and Operational Challenges for Automakers

The updated CAFE standards present a multifaceted financial and operational challenge for US automakers. Compliance requires significant capital investment in new vehicle platforms, powertrain technologies, and manufacturing processes, particularly for the transition to EVs. This investment is massive, diverting funds that might otherwise go toward dividends or other business initiatives. Furthermore, the risk of non-compliance carries substantial financial penalties, which can run into billions of dollars for major manufacturers if they miss their targets significantly. Managing these costs while maintaining profitability and shareholder value is a delicate balancing act.

Operationally, automakers face the daunting task of retooling factories, retraining vast workforces, and establishing entirely new supply chains. The shift to EVs, for instance, requires expertise in battery chemistry, electric motor design, and power electronics, areas where traditional automotive engineering might have less deep experience. Supply chain vulnerabilities, particularly for critical minerals and semiconductors, add another layer of complexity. Production ramp-up for new EV models also brings its own set of challenges, from quality control to achieving economies of scale. The entire organizational structure, from R&D to sales and service, needs to adapt to a rapidly evolving product mix and market reality.

R&D and manufacturing cost implications

Research and development costs are skyrocketing as automakers pour money into EV battery technology, electric motor design, lightweight materials, and advanced driver-assistance systems. Manufacturing facilities must be reconfigured or built from scratch to accommodate EV production, requiring enormous upfront capital. These expenditures can strain balance sheets, especially for companies that may not have the deep pockets of the largest global players. The cost per vehicle produced may initially increase as new technologies are integrated and production scales are not yet fully achieved. This initial premium for next-generation vehicles can be a barrier to consumer adoption, creating a tricky loop where higher costs might slow sales, which in turn slows cost reduction through economies of scale.

Supply chain disruptions and material sourcing

The automotive supply chain is already complex, and the transition to EVs introduces new vulnerabilities. Access to critical raw materials such as lithium, cobalt, nickel, and rare earth elements is a major concern. These materials are often sourced from politically unstable regions or processed in concentrated geographic areas, leading to potential supply disruptions and price volatility. Building secure, ethical, and localized supply chains for batteries and other EV components is a top priority, but it requires significant investment and long lead times. Geopolitical factors play a large role in the stability and accessibility of these vital resources. The recent semiconductor shortages offered a stark lesson on the fragility of global supply lines.

Workforce training and re-skilling

The shift to EVs implies a fundamental change in the skills required across the automotive workforce. Manufacturing roles will evolve from internal combustion engine assembly to battery pack construction and electric motor integration. Technicians in dealerships will need training on high-voltage systems and EV diagnostics. Engineers must pivot from optimizing gasoline engines to designing efficient electric powertrains and software. This demands massive investments in retraining and re-skilling programs to ensure the existing workforce remains relevant and capable, while also attracting new talent with specialized EV expertise. This human capital transformation is as critical as the technological one.

Consumer Adoption and Market Dynamics

The success of automakers in meeting CAFE standards by 2027 hinges not only on their ability to produce efficient vehicles but also on consumer willingness to purchase them. Market dynamics are crucial, as demand for electric and highly efficient vehicles directly impacts a manufacturer’s fleet-wide average. While growing, EV adoption is far from universal, facing barriers such as vehicle cost, charging infrastructure limitations, and range anxiety. Automakers must carefully balance regulatory pressures with consumer preferences, offering appealing and practical options that encourage the transition.

The role of government incentives, such as tax credits for EV purchases, also plays a significant part in shaping consumer behavior. These incentives can help offset the higher upfront cost of EVs, making them more competitive with traditional vehicles. However, the inconsistent nature of these incentives and eligibility requirements can create uncertainty for both consumers and manufacturers. Ultimately, automakers need to not only innovate technologically but also excel in marketing, education, and providing a seamless ownership experience to drive widespread consumer acceptance of the new vehicle landscape. The perception of EVs as “niche” products must shift to them being seen as mainstream, viable alternatives.

Factors influencing consumer purchasing decisions

Several factors influence whether consumers will choose a more fuel-efficient or electric vehicle:

- Upfront cost: EVs typically have a higher purchase price, despite potential long-term fuel savings.

- Charging infrastructure: Availability, speed, and reliability of public and home charging stations are critical.

- Range anxiety: Concerns about how far an EV can travel on a single charge and the availability of charging on long trips.

- Performance and features: EVs offer instant torque and a quiet ride, appealing to some, but preferences for traditional vehicle attributes remain.

- Brand perception and trust: Consumers often stick with familiar brands, and new EV entrants face a tougher climb.

- Maintenance and reliability: Perceived complexity or unknown long-term costs of EV maintenance.

- Environmental awareness: A growing segment of consumers prioritizes sustainability.

These factors combine to create a complex decision-making process for consumers, and automakers must address each point effectively to drive adoption. Building a compelling value proposition that goes beyond just fuel economy is essential. This often involves marketing the technological advantages, reduced operating costs, and environmental benefits of new vehicle types.

Role of government incentives and infrastructure

Government policies and infrastructure development are critical enablers of consumer adoption. Tax credits, rebates, and other financial incentives reduce the purchase barrier for EVs. Investments in establishing a nationwide charging network, including fast chargers on major highways and more accessible chargers in urban areas, will alleviate range anxiety and improve convenience. State and local incentives, such as HOV lane access or reduced registration fees, also play a role. Without robust government support for both the demand and supply sides, the pace of transition would be significantly slower. This collaborative effort helps bridge the gap between regulatory goals and market reality, creating a supportive ecosystem for new technologies.

The shift is not just an industry challenge; it’s a societal one that requires integrated policy, infrastructure, and market solutions. The success of the CAFE standards depends as much on the consumer side of the equation as it does on the producer.

Competitive Landscape and Global Implications

The updated CAFE standards in the US will not only reshape the domestic automotive market but also have significant ripple effects on the global competitive landscape. Automakers operating in the US, regardless of their country of origin, must comply with these stringent regulations. This creates both a level playing field in terms of environmental mandate and unique challenges for companies whose primary markets might have different regulatory priorities. European and Asian automakers, many of whom have been leaders in electrification and fuel efficiency due to their own regional regulations, may find themselves at an advantage, at least initially, in meeting US standards.

The global nature of the automotive industry means that technological advancements driven by US regulations can eventually spill over into other markets, and vice versa. Manufacturers are increasingly developing “global platforms” designed to meet diverse regulatory requirements in multiple regions, aiming for economies of scale. However, disparities in regulations can also lead to market fragmentation, requiring tailored product offerings for different regions. The race to electrify and improve efficiency is a global one, and the US CAFE standards are a major contributing factor, influencing decisions made in boardrooms worldwide. The standards are a strong signal of the direction of transportation policy in a major economic bloc.

Comparison with European and Asian efficiency standards

European and some Asian countries, particularly China, have often led the charge in setting aggressive emissions and fuel efficiency standards, sometimes even more stringent than those in the US. The European Union, for example, has binding CO2 emissions targets that dictate fleet-wide averages, with heavy fines for non-compliance. China, the world’s largest automotive market, has a robust NEV (New Energy Vehicle) credit system that strongly incentivizes EV production.

- Europe: Strict CO2 emissions targets (grams per kilometer) with high penalties. Emphasis on vehicle electrification and smaller, more efficient ICE vehicles.

- China: A complex dual-credit system (NEV credits for EVs and fuel consumption credits for ICE) that pushes manufacturers towards electrification. Massive government support for EV infrastructure and domestic EV manufacturers.

- Japan/South Korea: Focus on hybrid technology and continuous improvement in ICE efficiency, alongside growing EV ambitions.

These global benchmarks provide context for the US CAFE standards, suggesting that while challenging, the US is aligning with a broader international trend towards cleaner vehicles. The experience gained by foreign automakers in meeting their home market regulations could give them a competitive edge in the US.

Opportunities for US automakers in the global market

While challenging, the updated CAFE standards also present opportunities for US automakers to become global leaders in electrification and advanced fuel-efficient technologies. By investing heavily in R&D and manufacturing to meet domestic requirements, US companies can develop intellectual property and expertise that is exportable to other markets. The transition to EVs, in particular, offers a chance to redefine brand identities and capture new market segments both at home and abroad. Establishing strong domestic supply chains for batteries and other EV components can also enhance national security and economic independence, positioning the US as a hub for future automotive innovation. This innovation, driven by domestic policy, could lead to a global competitive advantage.

The competitive landscape is fluid, and the ability of US automakers to adapt quickly and innovate effectively will determine their long-term success on the world stage. The 2027 CAFE standards are not just a regulatory hurdle; they are a catalyst for global transformation within the industry.

Looking Beyond 2027: Future Outlook and Adaptations

The 2027 CAFE standards are not an endpoint but rather a significant milestone in a longer, ongoing journey toward a decarbonized transportation sector. The regulatory trajectory suggests that future standards will continue to become more stringent, pushing for even higher levels of electrification and efficiency. Automakers are already planning beyond 2027, envisioning product lineups dominated by electric vehicles and developing next-generation battery technologies, charging solutions, and autonomous driving capabilities. This long-term outlook requires strategic foresight and continuous adaptation.

The industry will also need to contend with evolving consumer preferences, potential technological breakthroughs, and unforeseen geopolitical shifts. The challenges of charging infrastructure, grid capacity, and raw material availability will continue to demand innovative solutions. Furthermore, the role of hydrogen fuel cell vehicles, synthetic fuels, and other alternative energy sources might become more prominent in the distant future. The automotive sector is undergoing a profound transformation, moving beyond simply manufacturing vehicles to becoming providers of comprehensive mobility solutions. This future requires flexibility and a willingness to embrace continuous change, driven by environmental imperative and technological progress.

Potential for further regulatory tightening post-2027

Given the clear direction of environmental policy both in the US and globally, it is highly likely that fuel economy and emissions standards will continue to tighten beyond 2027. Future regulations may target not only tailpipe emissions but also lifecycle emissions, including those from manufacturing and recycling. This could place even greater pressure on automakers to decarbonize their entire operations, not just their products. Policymakers may also introduce more explicit mandates for EV sales percentages or phase-out dates for ICE vehicles, similar to what some European countries have proposed. The regulatory environment is unlikely to ease, only intensify as climate goals become more urgent.

Long-term strategy for automakers

To thrive in the evolving automotive landscape, automakers are adopting comprehensive long-term strategies that include:

- Accelerated electrification: Phasing out ICE vehicle development in favor of fully electric platforms.

- Vertical integration: Investing in battery cell production and supply chains to secure critical components.

- Software-defined vehicles: Developing vehicles where software plays a central role in features, updates, and performance.

- New business models: Exploring mobility services, subscription models, and energy solutions beyond just vehicle sales.

- Sustainable manufacturing: Reducing the environmental footprint of production processes and materials.

- Partnerships and collaborations: Forming alliances to share technology, reduce costs, and accelerate development.

These strategies aim to build resilient, innovative companies capable of navigating a future where environmental stewardship, technological prowess, and evolving consumer needs are paramount. The auto industry is not merely adapting; it is reinventing itself for a new era of sustainable mobility. The ability to predict and proactively respond to changing regulatory and market demands will differentiate the leaders from those left behind.

| Key Point | Brief Description |

|---|---|

| 🚗💨 Accelerated Electrification | Tighter CAFE standards will drive US automakers to significantly increase EV production and sales to meet efficiency targets. |

| 💸 Investment & Penalties | Automakers face massive R&D and manufacturing investments, coupled with potential hefty fines for non-compliance. |

| ⚙️ ICE Innovation | Traditional gasoline vehicles will undergo significant technological upgrades to improve fuel efficiency, though their market share is expected to decline. |

| 🌍 Global Competitiveness | US standards align with global trends, potentially boosting US automakers’ competitiveness in sustainable vehicle technologies. |

Frequently Asked Questions

▼

CAFE (Corporate Average Fuel Economy) standards set average fuel efficiency targets for a manufacturer’s fleet of vehicles sold in the U.S. They are updated to reduce greenhouse gas emissions, decrease reliance on fossil fuels, and promote energy security. The 2027 updates are particularly aggressive, aiming to accelerate the transition to cleaner vehicle technologies and combat climate change effectively.

▼

The primary impact will be a forced acceleration towards electric vehicle (EV) production and sales, as EVs are crucial for meeting stringent fleet-wide efficiency targets. Automakers will also need to invest heavily in advanced technologies for traditional internal combustion engine (ICE) vehicles and face significant financial penalties if they fail to comply with the new mandates.

▼

Automakers face substantial financial challenges, including massive investments in research and development for new EV platforms and advanced ICE technologies. They must also retool factories, establish new supply chains for critical EV components, and retrain workforces. Non-compliance can lead to billions of dollars in fines, further straining financial resources.

▼

The updated US CAFE standards are increasingly aligning with, and in some cases becoming as stringent as, those in Europe and China. Both regions have aggressive CO2 emissions targets and robust incentives for electric vehicles. This global alignment encourages automakers to develop universal platforms for cleaner vehicles, potentially boosting US automakers’ competitiveness abroad.

▼

Consumer adoption is critical for automakers to meet fleet-wide averages. If consumers don’t buy enough highly efficient or electric vehicles, manufacturers will struggle to comply. Factors like EV purchase cost, charging infrastructure, and range anxiety influence consumer decisions. Government incentives and infrastructure development are vital to encourage widespread adoption and support the transition.

Conclusion

The updated CAFE standards for 2027 represent a transformative moment for US automakers, compelling a rapid evolution towards a more fuel-efficient and electrified future. While presenting formidable financial, operational, and market challenges, these regulations are also a powerful catalyst for innovation, potentially positioning American manufacturers at the forefront of global sustainable mobility. Success hinges on strategic investment in advanced technologies, robust supply chain development, workforce re-skilling, and a keen understanding of evolving consumer demand. The road to 2027 is paved with significant hurdles, yet it ultimately leads towards a greener, more competitive automotive landscape that benefits both industry and environment.